|

|

| Bennett Helps Students Try Their Hands at Passing Laws Earlier this week, a piece of legislation was heavily scrutinized as the subject of debate in a hearing to decide the proposal’s future, though the individuals conducting the meeting weren’t lawmakers, but high school students from the 53rd Senate District. The event was part of State Senator Tom Bennett’s (R-Gibson City) Youth Advisory Council (YAC) Program. “This program is a chance for me to connect with young people from the area who are interested in public policy, and then help them to get more involved,” said Bennett. “These are the future leaders of our communities, so it’s important for them to have a good path toward becoming engaged citizens and open their eyes toward possible careers in public service.” Bennett’s YAC is an ongoing program open to high school students from the 53rd Senate District. Students are able to meet with, and learn from, lawmakers, public advocates, community leaders, and lobbyists to learn more about the legislative process, as well as how to get involved. “I think it’s really important for us young kids to get involved, because we’re the future generation, and this could be us in a few years, and we need to know what we’re doing when we get to that time,” said El Paso Gridley High School student Lincoln Ringger. “I think it could benefit me on formulating opinions, taking both sides in, not being biased to anything, taking my own personal opinions out of it, and just listening to everybody.” On April 3rd, the students were in Pontiac, where they conducted a mock legislative hearing, serving as legislators, concerned citizens, and advocates, to debate legislation. “It’s taught me different ways of talking to people, communication and different problem-solving skills and being able to apply that to the real world,” said Prairie Central High School student Abram Cutrell. “Even if you don’t want to go into politics, it teaches you to get out of your comfort zone and talk to others and think about things in a different way.” Senator Bennett’s Youth Advisory Council will start again in the fall. He recommends that anyone interested in attending should ask their teacher or principal at their school about taking part. Homeschooled students are also welcome, and parents can inquire about the program by contacting Senator Bennett’s district office. Contact information can be found at SenatorTomBennett.com. |

| |

| Disaster Declaration Issued for Severe Weather Damages This past week has been filled with severe weather. Illinois saw 22 tornadoes on Friday to Tuesday in addition to Wednesday’s thunderstorms. Unfortunately, this weather brought with it property damage and, tragically, lost lives. As a result, on Saturday the Governor issued a disaster proclamation following the storms in an effort to provide some relief for communities. A disaster proclamation enables the state to provide immediate assistance to the communities outlined in the proclamation, in this case including Boone, Crawford, DuPage, Marion, and Sangamon counties. Additionally, the Governor has also directed the Illinois Emergency Management Agency to coordinate a statewide response. On average, April is one of the more frequent months for tornadoes in Illinois. Friday’s experience, however, is significantly outside the norm. Typically, Illinois sees eight to nine tornadoes throughout the entire month of April. | |

|

| Illinois One of the Highest Tax Burdens in United States With tax season ending April 18, it is time to take a closer look at what exactly that entails for the average Illinois resident. A study released by the personal finance website WalletHub, determined that Illinois has the ninth highest overall tax burden on its residents. To break it down, Illinois ranks tenth in the country for highest property tax and is in the top half of states for individual income and total sales and excise tax burdens. This study is based around the idea of tax burdens rather than tax rates. Tax rates can vary wildly depending on a taxpayers’ different circumstances, but tax burdens will reflect the amount of an individual’s income that is paid in a variety of taxes. By looking at that percentage, it is easier to see the impact of taxes on the average person. This study showed that when accounting for property, individual income, and sales and excise tax rates, Illinois residents lose 9.3% of their personal income to taxes. This division means almost one hour’s pay for every eight-hour work shift is being taken from Illinoisans when all taxes are accounted for. Lastly, this study also found a wide disparity between two groups of states. When averaged, Republican states have a significantly lower total tax burden than Democratic states. By averaging the rank of states with the highest tax burden, Republican states have a lower tax burden than the national average, while Democratic states have a higher tax burden. Illinois’ high tax burden coupled with record-high inflation are the major reasons that Senate Republicans continue to push for relief for Illinois families. Last week, Republican Senators made another public push for their measures that would provide Illinoisans with savings on food, drugs, childcare, and energy costs. You can review their proposals here. |

| |

| How much do we owe? As of the time of this writing, the State of Illinois owes $2,378,775,893 to state vendors, including 21,603 pending vouchers. This figure represents the amount of bills submitted to the office of the Comptroller and still awaiting payment. It does not include debts that can only be estimated, such as our unfunded pension liability which is subject to a wide range of factors and has been estimated to be more than $139 billion. At the same point last year, the estimated amount owed was just over $2 billion. | |

|

| Did You Know? Putnam County, part of which lies in the 53rd Senate District, has the oldest, still-in-use courthouse in the state of Illinois. The building, which is located in Hennepin, was constructed in 1839, the same year that the county’s current boundaries were established. It was built in the Greek Revival style and features four Doric columns in the front. In 1893, an addition was added to the North side of the structure. You can learn more about the history of the courthouse and the county here: https://www.villageofhennepin.com/2013/08/courthouse-one-of-putnam-countys-claims.html |

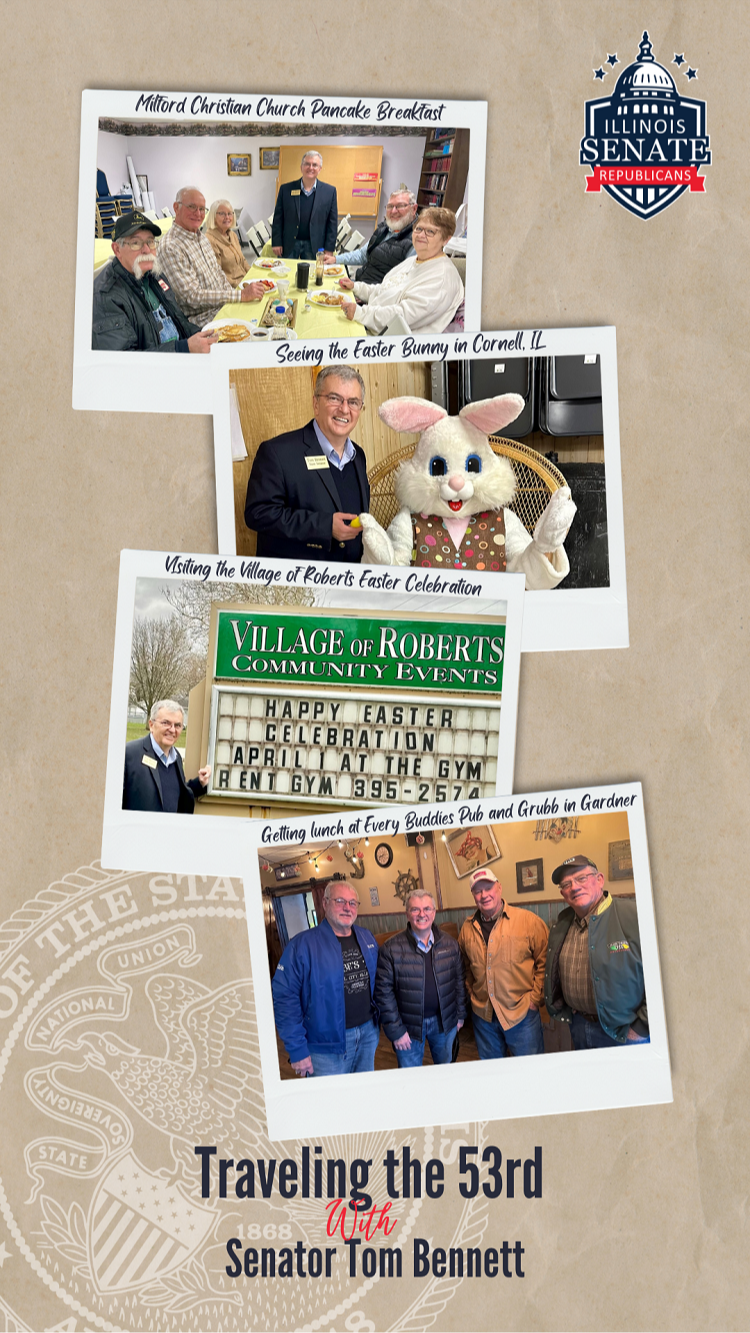

| This Week in the 53rd Senate District | |

| |